Understanding What Insurance Is Required In Florida

Understanding Required Insurance In Florida is crucial for residents. With its unique climate, laws, and lifestyle, Floridians face specific risks that require tailored insurance solutions. Whether for your vehicle, home, or health, knowing the types of coverage available can help you make informed decisions.

The Importance of Insurance in Florida Living

Insurance plays a vital role in protecting assets and ensuring peace of mind. In Florida, residents experience hurricanes, floods, and other natural disasters. Having proper coverage safeguards financial stability against these unpredictable events.

Additionally, Florida has a diverse population with varying needs. Young families, retirees, and seasonal residents all require different types of insurance. Each group needs to understand its specific requirements to manage risks effectively.

Moreover, Florida law requires certain types of insurance. This makes it even more important for residents to know what is necessary for compliance. Without adequate coverage, individuals may face significant penalties or financial hardships.

Understanding Required Insurance In Florida: Common Types

Many Floridians need specific types of insurance to navigate daily life. Auto insurance is mandatory, ensuring that drivers are protected on the road. Additionally, homeowners’ insurance is essential for anyone who owns property. This coverage helps protect against damage from storms and other disasters.

In many cases, renters’ insurance is also vital. This type of insurance covers personal belongings in rental properties. Furthermore, it provides liability coverage in the event of an accident. Many landlords require renters’ insurance before signing a lease.

Health insurance is another critical component of overall coverage. Floridians need to understand their options, including employer-sponsored plans and marketplace offerings. Each option has its benefits and limitations, making it important to evaluate choices carefully.

Understanding Required Insurance In Florida for Autos

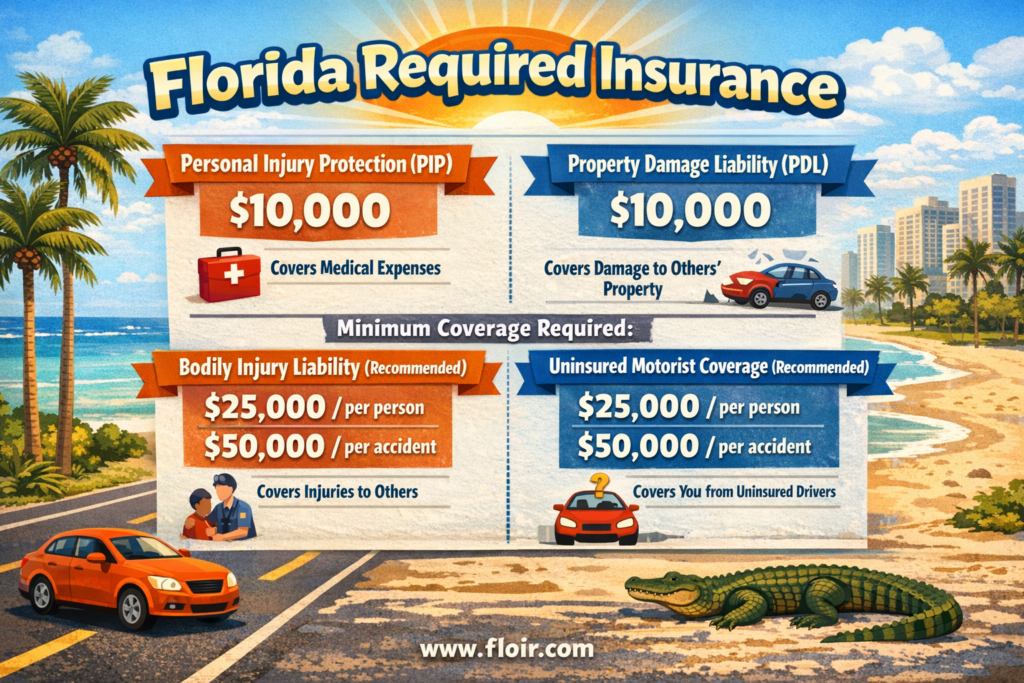

Auto insurance is not just a good idea in Florida; it is a legal requirement. Residents must carry a minimum level of personal injury protection (PIP) and property damage liability (PDL). PIP covers medical expenses and lost wages after an accident, while PDL handles damages to other vehicles or property.

Additionally, drivers must consider optional coverages like collision and comprehensive insurance. Collision coverage covers damage to your own vehicle after an accident, whereas comprehensive coverage protects against theft and natural disasters. While these options may not be mandatory, they provide essential peace of mind.

Moreover, Florida’s no-fault insurance system can complicate matters. In this system, each driver’s insurance pays for their injuries regardless of fault. As a result, understanding your rights and obligations becomes crucial when filing claims after an accident.

Homeowners Insurance: Understanding Required Insurance In Florida

Homeowners insurance protects your property and personal belongings against various risks. In Florida, where hurricanes and floods are common, having adequate coverage is vital. Most policies cover damage from storms, but flood insurance is often separate and necessary.

Additionally, liability coverage is part of most homeowners’ policies. This protects against lawsuits for injuries occurring on your property. Understanding your policy’s limits helps ensure you won’t face financial hardship if an accident occurs.

Moreover, many lenders require homeowners’ insurance to secure a mortgage. Without it, financing may not be possible. Therefore, knowing the types of coverage and ensuring adequate protection is essential for homeowners in Florida.

Navigating Health Insurance Options in Florida

Health insurance is crucial for maintaining well-being. In Florida, individuals have various coverage options. Some may receive insurance through their employers, while others may purchase plans on the health insurance marketplace.

The marketplace offers options to suit different budgets and needs. When selecting a plan, consider factors like premiums, deductibles, and covered services. Understanding these elements allows individuals to choose the best option for their healthcare needs.

Additionally, special programs may assist low-income residents. Medicaid and the Children’s Health Insurance Program (CHIP) provide essential coverage for eligible families. Exploring all available options ensures that Floridians have access to the care they need.

Conclusion On Understanding Required Insurance In Florida

In conclusion, being informed allows residents to navigate risks and comply with legal requirements effectively. By evaluating personal needs and exploring options, Floridians can protect themselves and their assets. Taking proactive steps to secure insurance can lead to a more secure, stress-free life in the Sunshine State.

Being informed allows residents to navigate risks and comply with legal requirements effectively. By evaluating personal needs and exploring options, Floridians can protect themselves and their assets. Taking proactive steps to secure insurance can lead to a more secure, stress-free life in the Sunshine State.